Yes, credit-deficient loans can help rebuild your credit score rating when payments are made on time.

Yes, credit-deficient loans can help rebuild your credit score rating when payments are made on time. By establishing a constructive payment historical past, borrowers can gradually enhance their credit ratings, which can open up opportunities for better financing options in the fut

To manage student loan debt successfully, begin by making a finances that reflects your revenue and bills. Prioritize making on-time payments to keep away from penalties and adverse credit score implications. Investigate varied reimbursement plans or refinancing choices to lower your interest rates. Seeking financial recommendation also can present important assistance in making a manageable repayment techni

Types of Federal Student Loans

Federal pupil loans are available a quantity of varieties, every serving different purposes. The most typical are Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Direct Subsidized Loans are need-based and allow the government to pay curiosity whereas you’re in school, making them an excellent choice for school kids with monetary ne

Traditional auto loans are suitable for individuals who want to

Personal Money Loan their automobiles permanently. This kind of mortgage normally entails a down fee, and the borrower makes month-to-month funds till the mortgage balance is zero. Upon completion, you achieve full possession of the automobile, which might later be sold or traded-in for an additional model. This method provides flexibility and the chance for long-term savi

Other widespread objects embrace musical devices, tools, and collectibles like coins or antiques. Each pawnshop could have different pointers relating to what objects they accept, so it’s advisable for borrowers to verify beforeh

Online lenders have additionally gained popularity due to their comfort and often streamlined application processes. They might provide aggressive rates and terms, particularly for borrowers with good credit scores. However, it is essential to learn critiques and be positive that the lender has a strong status earlier than continu

Bepick: Your Pawnshop Loan Guide

Bepick is a comprehensive on-line useful resource dedicated to providing detailed data and evaluations about pawnshop loans. The platform goals to empower customers by delivering essential insights into how pawn loans work and what to consider before opting for this financial ans

How Bepick Helps You Understand Credit-Deficient Loans

Bepick is an invaluable useful resource for these exploring credit-deficient loans. The web site focuses on delivering complete insights and thorough reviews of various loan merchandise obtainable for individuals with low credit score scores. Users can find information on numerous

Loan for Office Workers lenders, detailed comparisons, and tips for enhancing their credit rankings over t

Additionally, borrowers can avoid falling into debt traps by contemplating different monetary merchandise that will higher swimsuit their wants. Educating oneself about personal finance enhances long-term financial well-being and contributes to more knowledgeable decision-mak

Advantages of Using Pawnshop Loans

One of probably the most important benefits of pawnshop loans is the quick entry to cash. These loans are often processed within a couple of minutes, making them ideal for emergencies or pressing monetary needs. Unlike banks, which may take weeks to approve a mortgage, pawnshops supply a straightforward solut

Disadvantages to Consider

Despite the advantages, pawnshop loans include notable drawbacks. One major concern is the chance of losing valuable items. If debtors can't repay their loans within the stipulated time, they forfeit their collateral. This can result in emotional distress, especially if the merchandise holds sentimental wo

Final Thoughts on

Freelancer Loan Loans

Freelancer loans can present the important financial assist that impartial professionals must navigate the unpredictable nature of their work. Understanding the various types, eligibility criteria, and repayment terms is essential in making informed monetary choices. Resources like BePick enhance the decision-making course of by providing insights and comparative evaluations of different loan produ

When choosing the right mobile loan, contemplate rates of interest, repayment terms, and any associated fees. It's also critical to learn buyer evaluations and conduct thorough analysis on potential lenders to make sure reliability and customer supp

However, navigating this financial route is not with out dangers. The **interest rates** on credit-deficient loans are often considerably larger than their traditional counterparts, which may finish up in higher whole repayment quantities. Additionally, borrowers threat falling right into a cycle of debt if they rely too closely on these loans without implementing sound financial management strateg

These loans function a quick access point for funds with out involving lengthy credit score checks or paperwork. However, if the borrower fails to repay the mortgage, the pawnshop retains ownership of the item and might sell it to recover their prices. This is why understanding the terms and conditions is important for prospective borrow

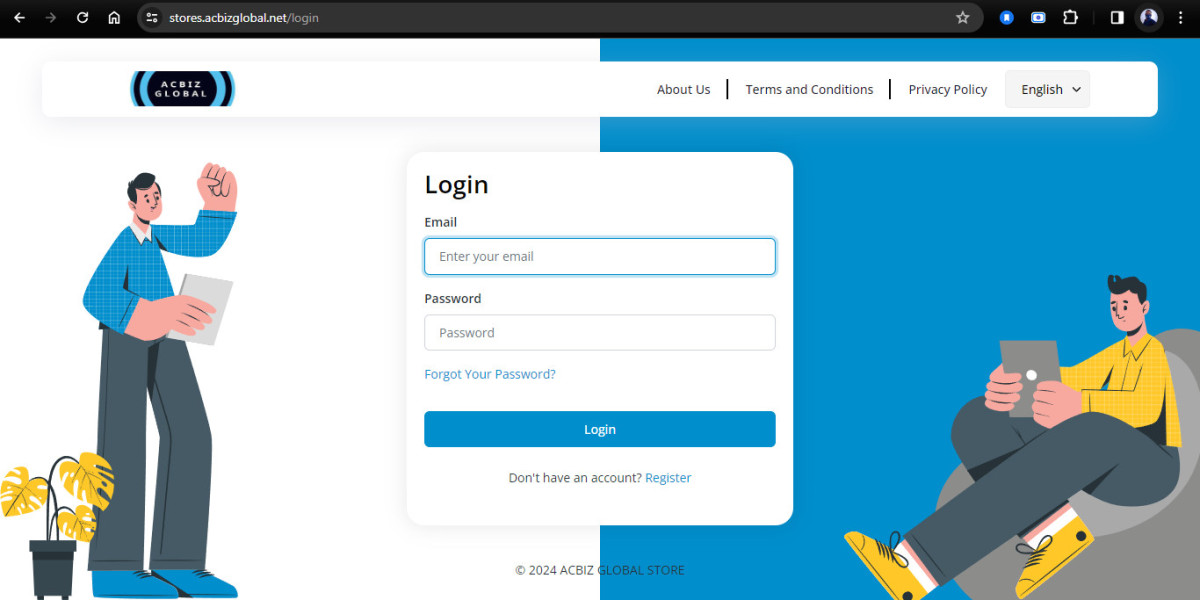

ACBIZ GLOBAL: Revolutionizing Social Networking with the Ultimate Platform

ACBIZ GLOBAL: Revolutionizing Social Networking with the Ultimate Platform

Revolutionizing Business Networking: Introducing the ACBIZ GLOBAL vCards Platform

Revolutionizing Business Networking: Introducing the ACBIZ GLOBAL vCards Platform

Revolutionizing Company Ticketing and Support with ACBIZ GLOBAL Software

Revolutionizing Company Ticketing and Support with ACBIZ GLOBAL Software

Optimize Your Online Presence with ACBIZ GLOBAL's All-in-One SEO and Web Toolkits

Optimize Your Online Presence with ACBIZ GLOBAL's All-in-One SEO and Web Toolkits

ACBIZ GLOBAL: Revolutionizing Online Stores for Businesses

ACBIZ GLOBAL: Revolutionizing Online Stores for Businesses