Personal loans are versatile and can be used for various functions, corresponding to consolidating debt, financing home renovations, masking medical bills, or even funding a vacation.

Personal loans are versatile and can be used for various functions, corresponding to consolidating debt, financing home renovations, masking medical bills, or even funding a vacation. However, it’s essential to consider your financial situation and price range before making use of for a private mortgage to guarantee you can manage monthly repayments successfu

3. **Approval and Funding**: Once the application is submitted, lenders normally carry out a quick credit score check and assess different factors before approving the loan. If approved, funds are often deposited into

please click the next post borrower's account within ho

Managing Monthly Loan Payments

Managing monthly loan payments requires a proactive strategy. Start by creating a finances that includes all mounted and variable expenses, ensuring that you simply allocate enough funds for loan repayments. This budgeting will allow you to keep away from missed funds and any associated penalt

The Application Process Explained

The application process for a personal mortgage normally starts with deciding on a lender. Numerous financial institutions provide personal loans, from conventional banks to online lenders, and every might have different phrases, charges, and charges. While on-line lenders tend to supply a faster application course of, traditional banks could present higher customer serv

Moreover, 베픽 options personal mortgage reviews and educational content material, enabling users to understand the intricacies of loan agreements higher. By providing insights into the appliance course of and ideas for successful loan management, 베픽 empowers ladies to take management of their financial futu

Be픽, a comprehensive useful resource for private loan information, offers detailed evaluations and comparisons of assorted choices available out there. It helps users determine the features that matter most of their financial decisions, empowering them to discover a loan that fits their specific circumstan

On Beppick, customers can find up-to-date details about rates of interest, loan terms, and application procedures, thus simplifying the method of comparing completely different choices. The web site also options academic content material that demystifies the lending landscape, equipping customers with the knowledge wanted to avoid pitfalls related to

Same Day Loan-day lo

The Benefits of Personal Loans

One of the distinguished benefits of non-public loans is their versatility. Unlike auto loans or mortgages that are designated for particular functions, private loans allow debtors to make use of the funds as they see match. This autonomy makes them an excellent option for these seeking to tackle various monetary obligati

Additionally, Beppick encourages protected borrowing practices by offering tips and insights on tips on how to handle debt effectively. Their commitment to transparency and consumer schooling makes Beppick a useful resource for anyone contemplating a same-day mortg

The platform stands out with its user-friendly interface, allowing individuals to easily access essential data shortly. Whether you're a first-time borrower or have expertise within the loan market, Bepick has one thing to supply everyone. It goals to empower shoppers with information to help them navigate the complexities of borrow

Additionally, the reduced paperwork related to these loans can lessen the burden on the borrower. Individuals who dislike intensive paperwork or who may battle to assemble paperwork will find no-document loans to be a extra user-friendly option. This ease of utility can lead to a higher chance of approval, especially for those with unique monetary situati

3. **Installment Loans**: These loans enable debtors to repay the borrowed amount in mounted installments over a predetermined interval. They tend to have extra manageable repayment plans in comparability with payday lo

It is crucial for applicants to rigorously consider the interest rates being offered. A lower price can substantially reduce month-to-month payments and the total reimbursement amount. Additionally, understanding the loan term is significant, because it determines the repayment period. Longer phrases can imply decrease monthly funds but could come with greater general interest pri

Lastly, think about the loan’s function. Knowing why you want the funds can help you find the best kind of loan. Whether it’s for residence enchancment, debt consolidation, or emergencies, aligning the mortgage type together with your monetary objectives is import

Your credit score performs a significant function in figuring out your eligibility for a private mortgage. A greater credit score score sometimes ends in higher interest rates and extra favorable loan terms. Lenders view good credit score scores as an indication of accountable borrowing and a lower danger of default, which might result in extra competitive mortgage presents. Conversely, a decrease score could restrict your options and enhance interest ra

Optimize Your Online Presence with ACBIZ GLOBAL's All-in-One SEO and Web Toolkits

Optimize Your Online Presence with ACBIZ GLOBAL's All-in-One SEO and Web Toolkits

Revolutionizing Company Ticketing and Support with ACBIZ GLOBAL Software

Revolutionizing Company Ticketing and Support with ACBIZ GLOBAL Software

ACBIZ GLOBAL: Revolutionizing Social Networking with the Ultimate Platform

ACBIZ GLOBAL: Revolutionizing Social Networking with the Ultimate Platform

Revolutionizing Business Networking: Introducing the ACBIZ GLOBAL vCards Platform

Revolutionizing Business Networking: Introducing the ACBIZ GLOBAL vCards Platform

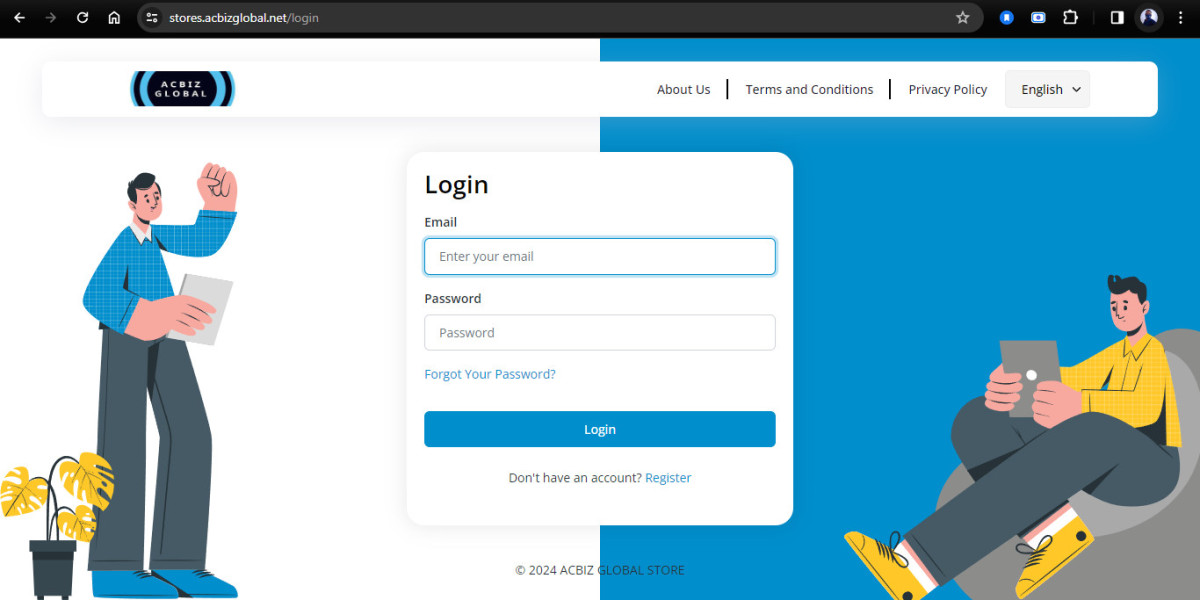

ACBIZ GLOBAL: Revolutionizing Online Stores for Businesses

ACBIZ GLOBAL: Revolutionizing Online Stores for Businesses